Reversing a Payment

Reversing (voiding) a payment helps ensure your reports and sales include accurate information.

Instead of reversing payments individually, you can also reverse payments when voiding a sale.

Link copiedReversing a payment

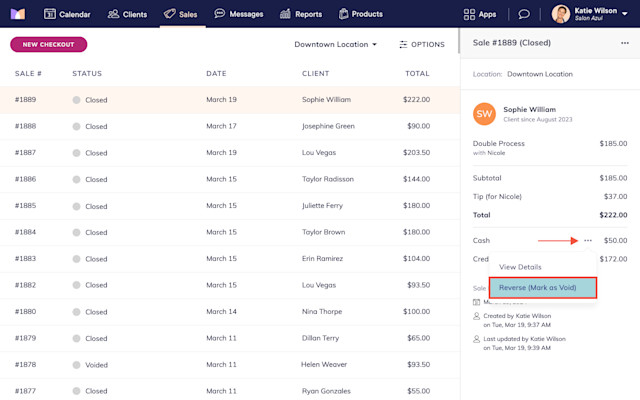

To reverse a payment, open the Sales app and select the sale with the payment to reverse.

Select Reverse from the "..." menu next to the payment. The Reverse option is not available for credit card payments. Instead, credit card payments can be refunded.

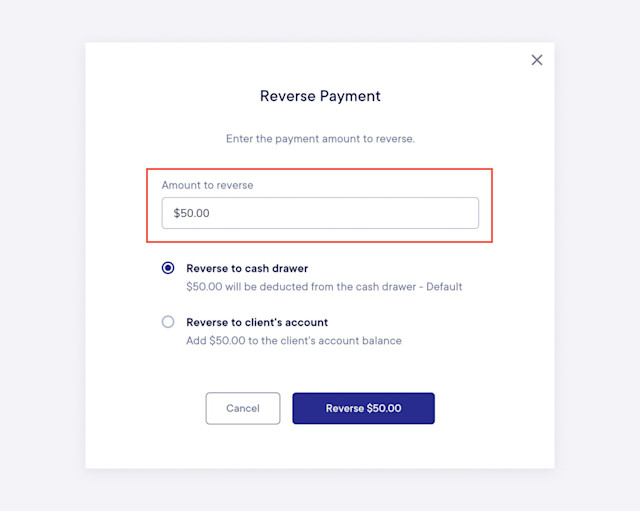

To reverse the full amount, leave the Amount to reverse as is. To reverse a partial amount, change the Amount to reverse to the partial amount.

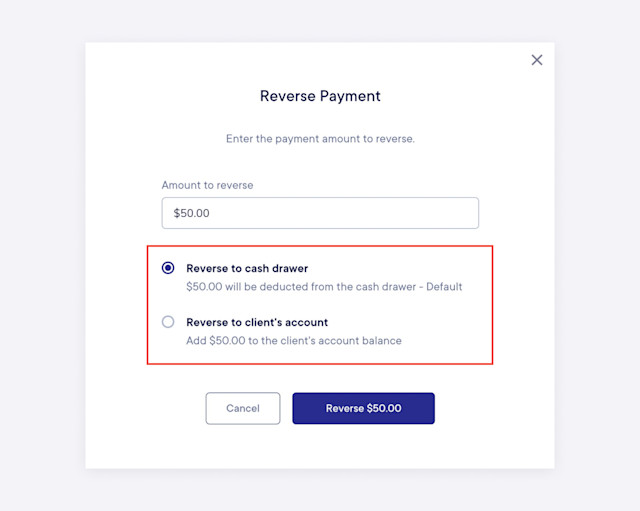

Specify whether to reverse the amount to the original payment method or the client's account balance.

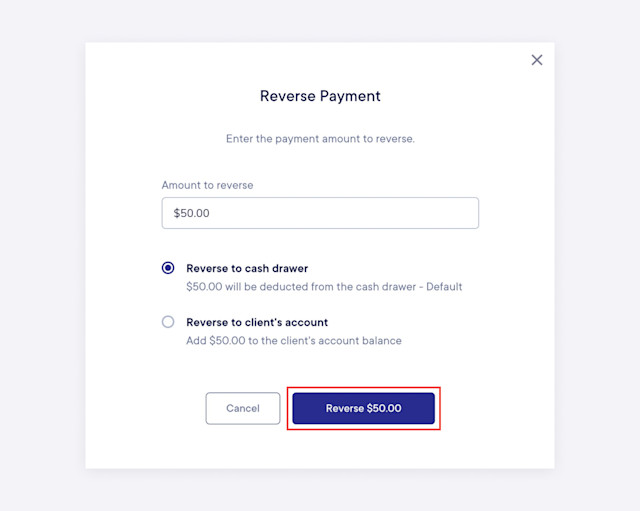

Select Reverse to complete the reversal.

The original payment will appear in your reports on the original payment date. The reversal will appear in your reports on the date it was completed.

Reversing a gift card payment will automatically return the funds to the gift card.

Reversing a cash payment will immediately affect the expected balance of the cash drawer. For example, if you reverse an $80 cash payment, $80 will be immediately deducted from the cash drawer balance.

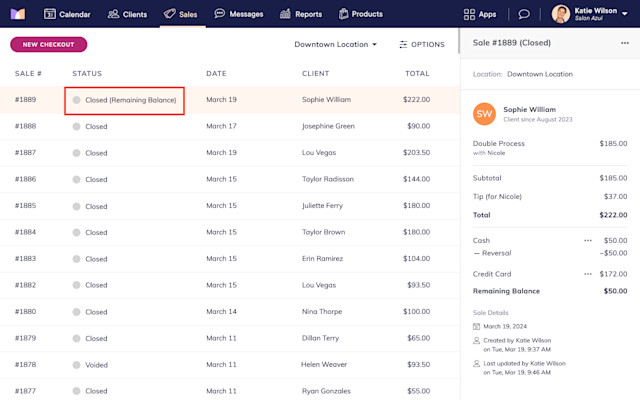

Link copiedWhat does the Closed (Remaining Balance) status mean?

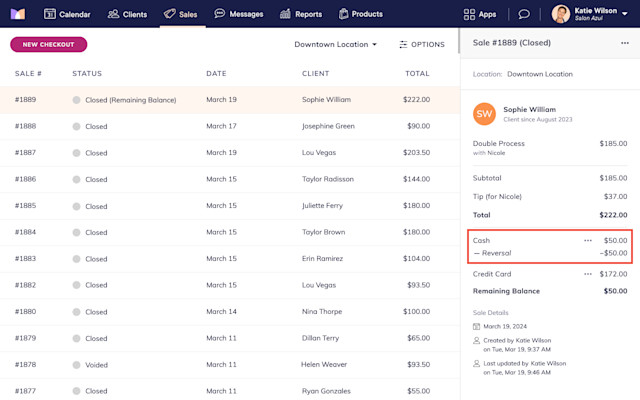

If you reversed a payment in a closed sale, the sale will have a status of Closed (Remaining Balance). This means the sale is still closed, but there is now a remaining balance because a payment was reversed.

You can either leave the sale as Closed (Remaining Balance), or you can change the sale back to a Closed status by:

Reopening the sale and collecting payment for the remaining balance

Reopening the sale and changing the price of the line items to account for the reversed payment

Sales with a Closed (Remaining Balance) status will still be included in Sales reports and the Payroll report.

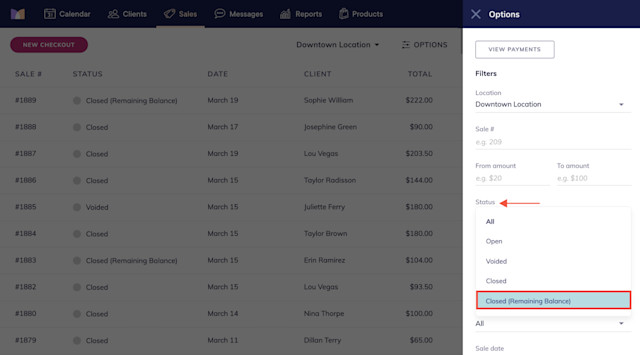

To find sales with a Closed (Remaining Balance) status, you can filter the Sales app.

Link copiedHow does reversing a payment affect reports?

The following reports are affected when a payment is reversed:

Payment Summary and Payment Details: These reports include reversal payments.

Cash Drawer Activity: This report includes reversed cash payments.

Gift Card Usage: This report includes reversed gift card payments.

Gift Card Balances: This report includes updated gift card balances when gift card payments are reversed. If a gift card payment is reversed, the funds are automatically returned to the gift card.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.