FAQ: Payroll Processing

- Link copied

How much does Payroll Processing cost?

Payroll Processing is available as an add-on and costs $50/month + $8/month per worker.

If you use multiple payroll accounts, each payroll account signed up for Payroll Processing costs $50/month + $8/month per worker.

Payroll Processing includes unlimited payroll runs. There is no additional cost to run payroll multiple times a month. This includes regular payroll runs and off-cycle payroll runs.

- Link copied

Which pay schedules are supported?

We support weekly, bi-weekly, semi-monthly, and monthly pay schedules.

- Link copied

Which compensation methods are supported?

We support hourly, commission (service and products), and salary compensation methods.

We also support greater-of compensation. This allows you to compare hourly and commission earnings on a daily basis or per pay period and only pay a worker the higher amount.

- Link copied

Can I pay my workers via direct deposit?

Yes, you can pay your workers via direct deposit. Learn more about the payroll processing schedule, including processing deadlines.

- Link copied

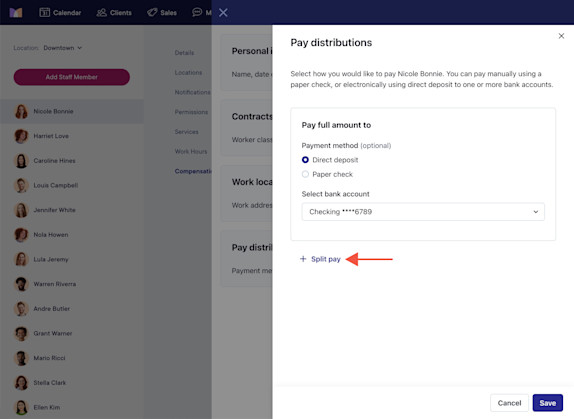

Can my workers distribute their direct deposit payments between multiple bank accounts?

Yes, workers can split their direct deposit payments between up to 3 bank accounts. Direct deposit payments can be split based on a percentage (%) or a fixed dollar amount ($).

When workers complete their email invitation to sign up for Payroll Processing, they can enter the details for each bank account they want to use.

If you would like to update a worker's direct deposit details on their behalf, go to Apps > Staff Members > Compensation > Access payroll setup. Select Edit next to Pay distributions.

Select Split pay and specify the details for each bank account to use.

![]()

- Link copied

How do I set up benefit calculations and time off?

After signing up for Payroll Processing, you can set up benefit calculations and time off policies for your workers.

When adding benefit calculations, you can set up calculations for:

Retirement benefits such as a 401(k) or Roth 401(k)

Health benefits such as medical, dental, and vision insurance

When adding time off, you can set up policies for paid time off (PTO) and unpaid time off. Time off policies are useful for things like vacation or sick time.

To set up benefit calculations and time off policies, open the Settings app and select Business Setup > Payroll.

If you have one payroll account, select Account settings. If you have multiple payroll accounts, select Manage account > Account settings.

Select Edit next to Benefits or Time off.

After setting up benefits and time off, you can assign the policies to each staff member by going to Apps > Staff Members > Compensation > Access payroll setup.

The system will calculate the amount for each benefit so that it is subtracted from the worker’s net pay, but the amount will not be debited from the employer. As the employer, you must review all benefit calculations and send the funds to the appropriate agencies.

- Link copied

How do I run an off-cycle payroll?

If you need to run payroll for an off-cycle pay period, open the Payroll app and select Options > Run off-cycle payroll.

When running an off-cycle payroll, you can specify the details of the off-cycle payroll run, including the staff members and time period.

If you pay a worker through an off-cycle payroll and then run a regular payroll that includes the same dates, the worker will not be paid twice for those dates. The worker will only be paid for any dates that were not already paid through the off-cycle payroll.

- Link copied

What is the difference between a 1099-NEC and a 1099-K?

Forms 1099-NEC and 1099-K are used for different purposes.

Form 1099-NEC is used to report nonemployee compensation for workers such as independent contractors and freelancers. If you are an independent contractor or freelancer, you will receive a 1099-NEC from your employer.

Form 1099-K is used to report payments and transactions completed through third-party networks. If you are an independent contractor or freelancer and you processed payments through Mangomint's payment processing, you may receive a 1099-K from Mangomint if you received over a certain amount in payments, or if you processed more than a certain number of transactions. To learn more about the reporting threshold for Form 1099-K, visit the IRS website.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.