Signing Up for Payroll as an Employer

To sign up for Payroll Processing as an employer:

Book a call with our team to begin the signup process.

Download this checklist and gather the required information to prepare for your call.

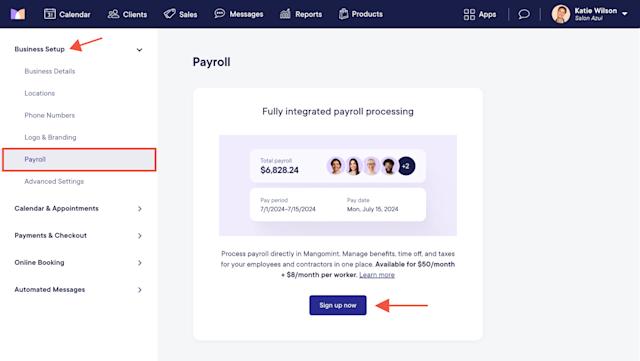

After completing the call with our team, open the Settings app and select Business Setup > Payroll.

Select Sign up now.

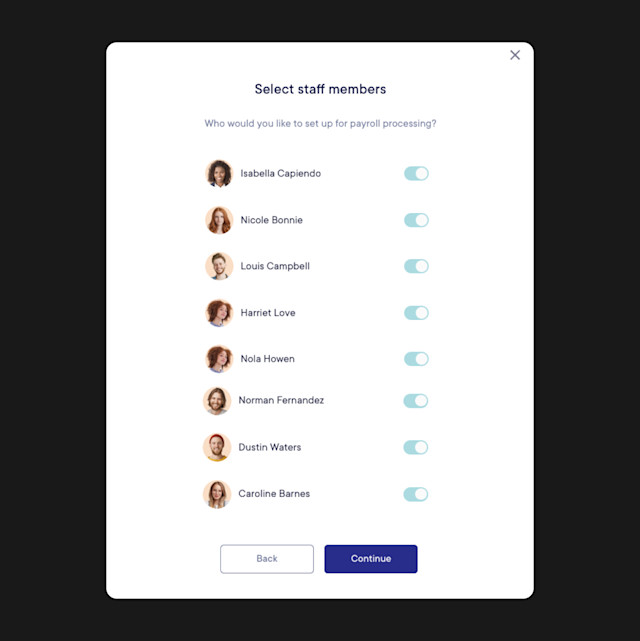

Once you select Sign up now, you can select the staff members to enable for Payroll Processing. You will be able to add and remove staff members from your payroll later as needed.

Payroll Processing costs $50/month + $8/month per worker. If you use multiple payroll accounts, each payroll account signed up for Payroll Processing costs $50/month + $8/month per worker.

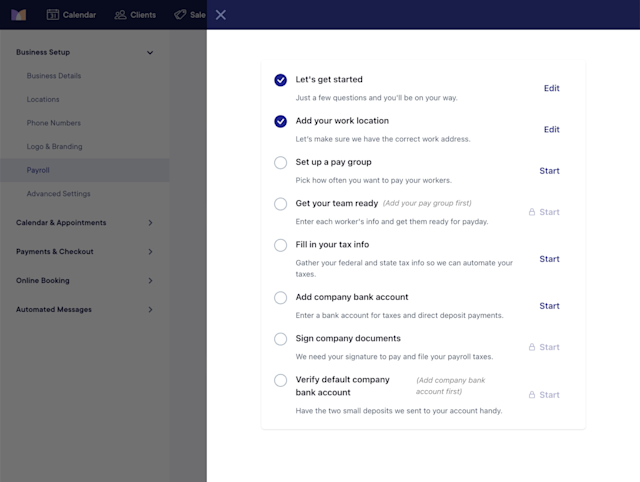

Continue the signup process by following the instructions for each section. You can find more information here on how to complete each section.

If you need help during the onboarding process, contact chat support for assistance. To ensure you’re compliant with state and federal tax and employment requirements, please consult an accountant.

Once you’ve completed each section of the onboarding process and your workers’ payroll details have been set up, you can run payroll in Mangomint.

Learn how you can view or update your payroll account details after onboarding.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.