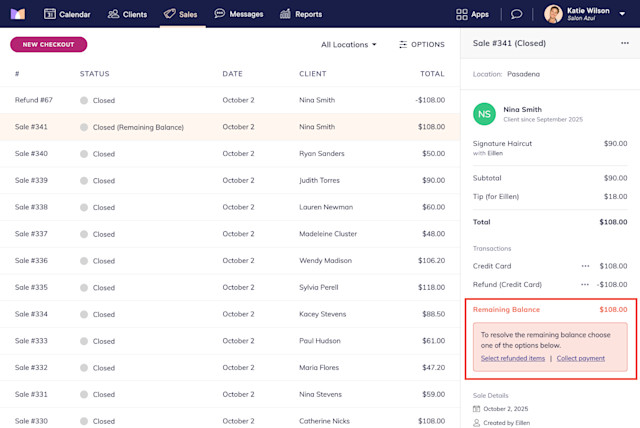

Resolving a Remaining Balance

When a refund is completed in a closed sale, the sale will have a status of Closed (Remaining Balance) if:

An amount was refunded instead of line items.

The sale had multiple payments, and only a single payment was refunded.

To ensure you have accurate reports, you will need to resolve the remaining balance. However, sales with a Closed (Remaining Balance) status are still closed and will still be included in Sales reports and the Payroll report.

Link copiedResolving a remaining balanceLink copied

To resolve a remaining balance in a closed sale, select the sale and specify how to resolve the balance.

Select refunded items: This option allows you to assign the refunded amount to specific line items in the sale, allowing you to also adjust commission, add products back to your inventory, and more.

Collect payment: This option allows you to collect a new payment for the refunded amount. This is helpful if the client requested a refund so they could use a different payment method.

Link copiedSelect refunded itemsLink copied

If you chose Select refunded items, you can resolve the remaining balance by assigning the refunded amount to specific line items in the sale.

A separate refund will be created for the sale, which will keep track of how the balance was resolved and which line items were refunded.

The status of the sale will change to Closed (Partially Refunded) or Closed (Refunded), depending on whether the sale is partially or fully refunded.

Link copiedCollect paymentLink copied

If you chose Collect payment, you can resolve the remaining balance by collecting a new payment for the refunded amount. This is helpful if the client requested a refund so they could use a different payment method.

Once the payment is complete and the balance is resolved, the status of the sale will change to Closed.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.