Refunding a Single Payment

In addition to completing refunds via the "..." menu for a sale, you can complete refunds via the "..." menu for single payments. This can be helpful for sales with multiple payments.

When refunding a single payment, you will only be able to refund to the original payment method or to the client’s account balance. If you’d like to refund the payment in a different way, such as cash, you will need to complete the refund from the "..." menu for the sale by using the Refund amount option.

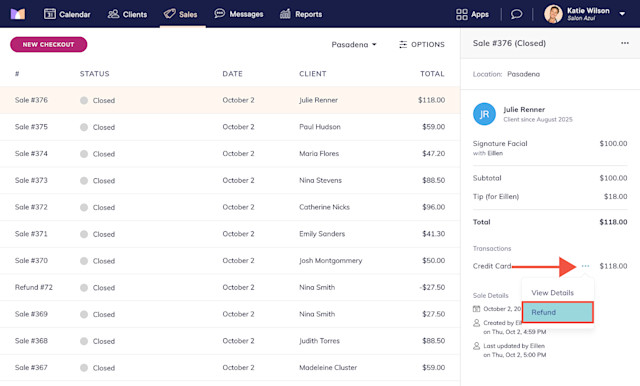

Link copiedRefunding a single payment in a closed saleLink copied

To refund a single payment in a closed sale, view the sale and select Refund from the "..." menu next to the payment.

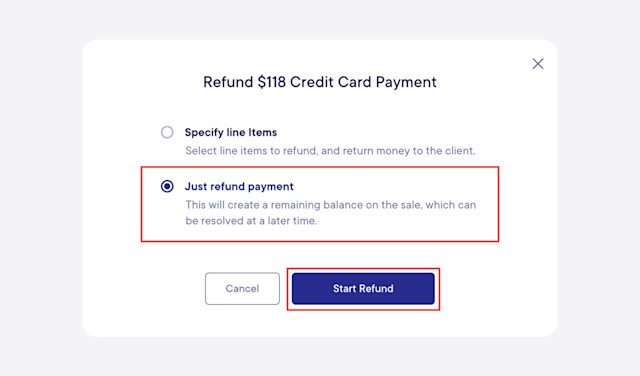

Select Just refund payment and select Start Refund.

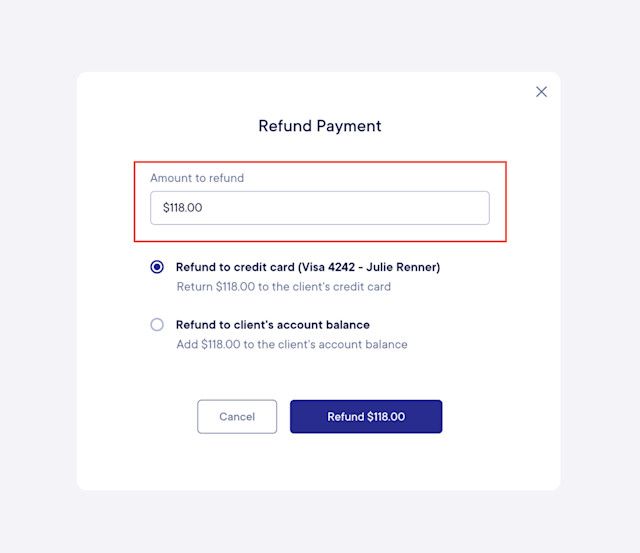

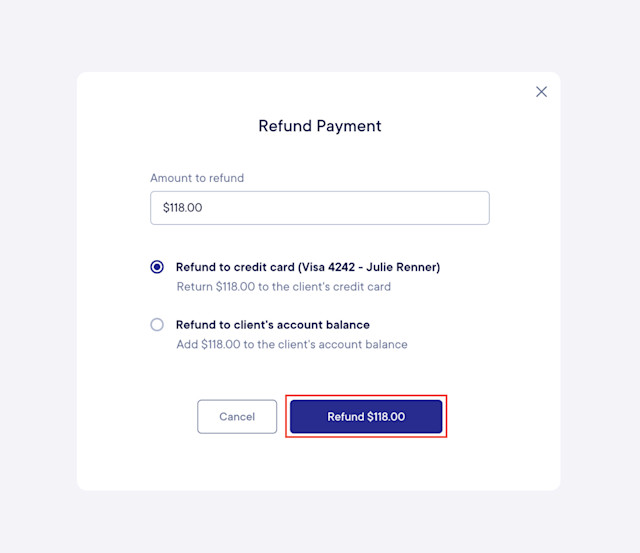

To refund the full amount, leave the Amount to refund as is. To refund a partial amount, change the Amount to refund to the partial amount.

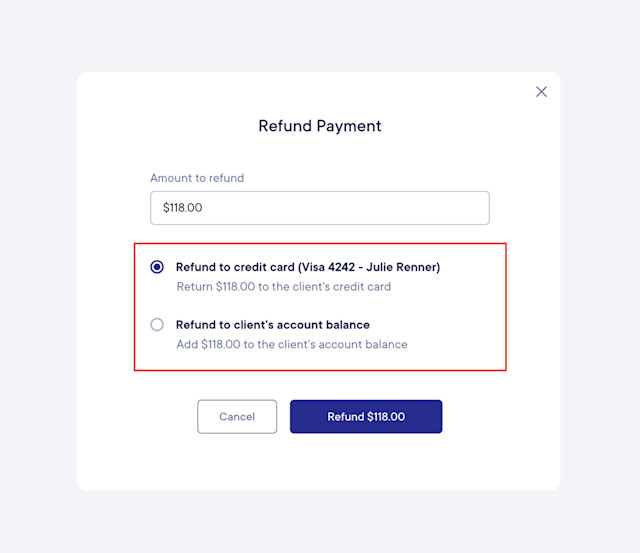

Specify whether to refund the amount to the original payment method or to the client's account balance.

Select Refund to complete the refund. The original payment will appear in your reports on the original payment date. The refund will appear in your reports on the date the refund was completed.

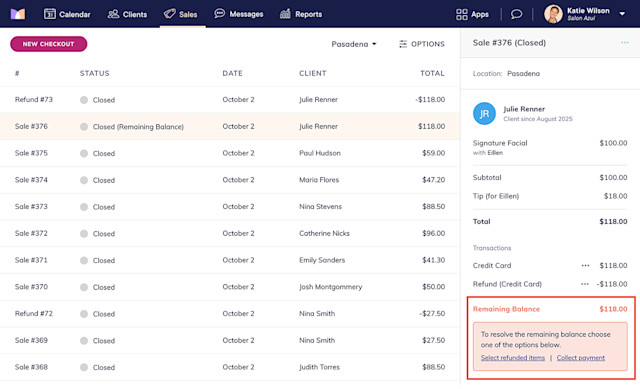

The sale will have a status of Closed (Remaining Balance). To ensure you have accurate reports, you will need to resolve the remaining balance. However, sales with a Closed (Remaining Balance) status are still closed and will still be included in Sales reports and the Payroll report.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.