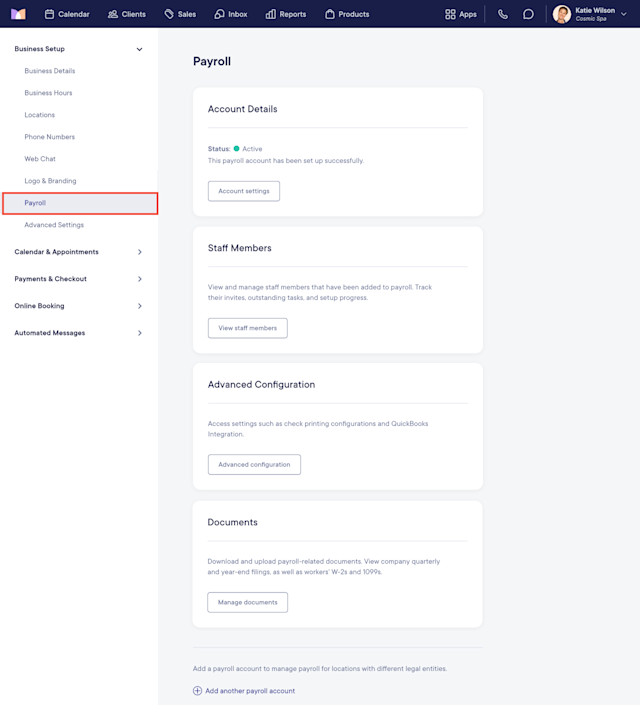

Payroll Settings

To manage your payroll settings and access your payroll documents as an employer, open the Settings app and select Business Setup > Payroll.

Link copiedAccount DetailsLink copied

To view or update your payroll account details, open the Settings app and select Business Setup > Payroll > Account settings. If you have multiple payroll accounts, select Manage account > Account settings.

When updating your payroll account settings, you can:

Manage your pay groups and bank accounts

Set up benefit calculations

Create time off policies

Link copiedStaff MembersLink copied

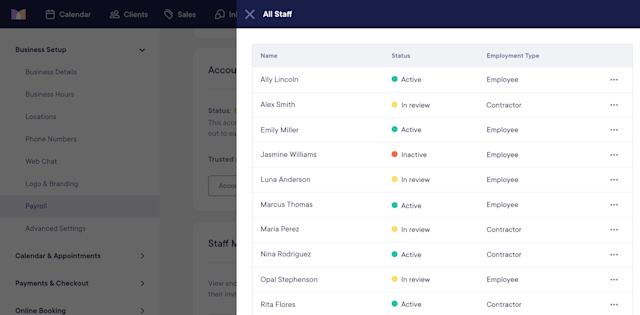

To view a list of all the workers on your payroll, open the Settings app and select Business Setup > Payroll > View staff members. If you have multiple payroll accounts, select Manage account > View staff members.

When viewing the list of all your workers, you can:

See which staff members have been invited to sign up for payroll, which staff members are active or inactive, etc.

See whether each staff member is an employee or contractor, or if that selection is still missing.

Select the "..." menu for each staff member to view the staff member's profile and see their payment history.

Link copiedAdvanced ConfigurationLink copied

To manage advanced payroll settings, open the Settings app and select Business Setup > Payroll > Advanced configuration. If you have multiple payroll accounts, select Manage account > Advanced configuration.

When managing advanced payroll settings, you can:

Update check printing preferences when paying workers via paper check.

Set up the QuickBooks Payroll Sync.

Link copiedDocumentsLink copied

To upload or download payroll-related documents (e.g. year-end tax documents), open the Settings app and select Business Setup > Payroll > Manage documents. If you have multiple payroll accounts, select Manage account > Manage documents.

Learn more about viewing your tax documents as an employer.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.