FAQ: Services

Link copied

What happens if I change a service price?

Link copied

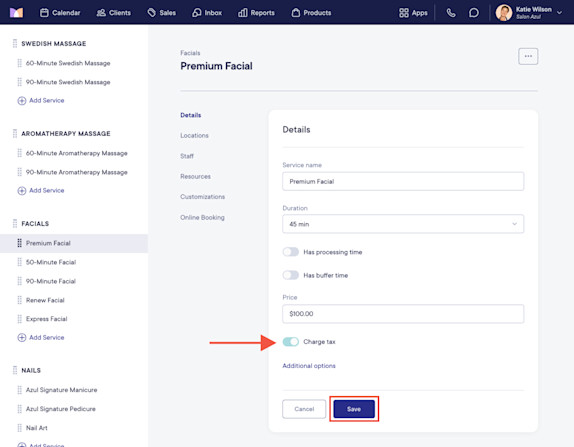

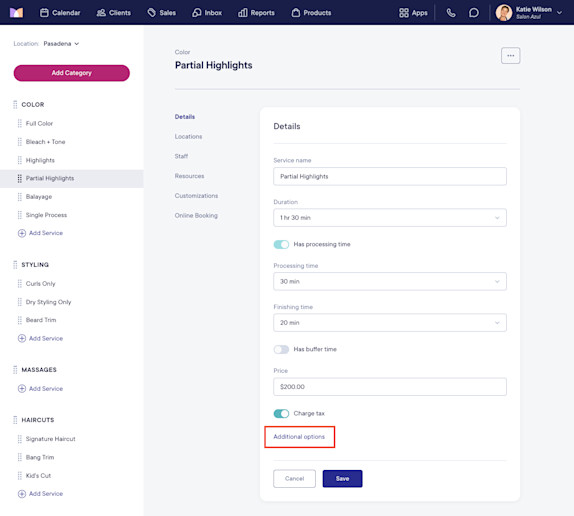

How do I enable or disable taxes on services?

Link copied

Can I set up a service that is only available on specific days or during specific times?

Link copied

Can I create a service that doesn't require a staff member?

Link copied

How do I deduct a backbar fee for my services?

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.