Setting Up the QuickBooks Payroll Sync

When you run payroll in Mangomint, you can sync your payroll data with QuickBooks Online automatically. This eliminates the need to export payroll data to QuickBooks manually, and it ensures your books stay up to date.

Link copiedSetting up the QuickBooks payroll syncLink copied

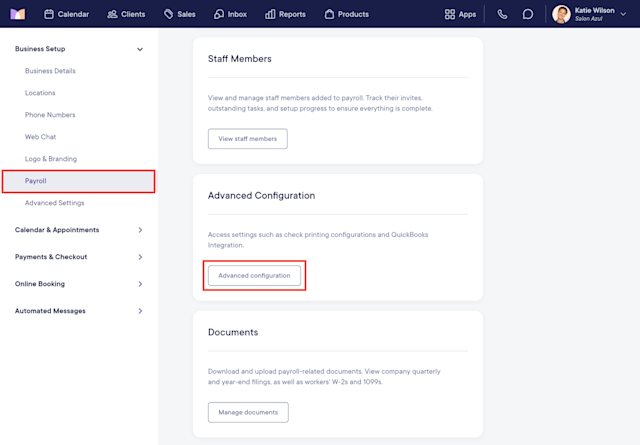

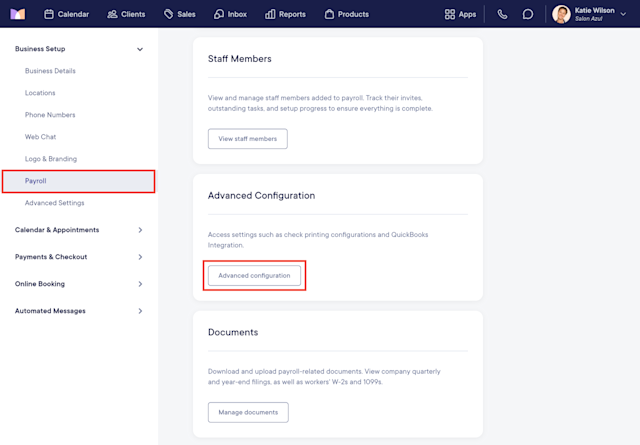

To set up the QuickBooks payroll sync, open the Settings app and go to Business Setup > Payroll > Advanced configuration. If you have multiple payroll accounts, select Manage account > Advanced configuration.

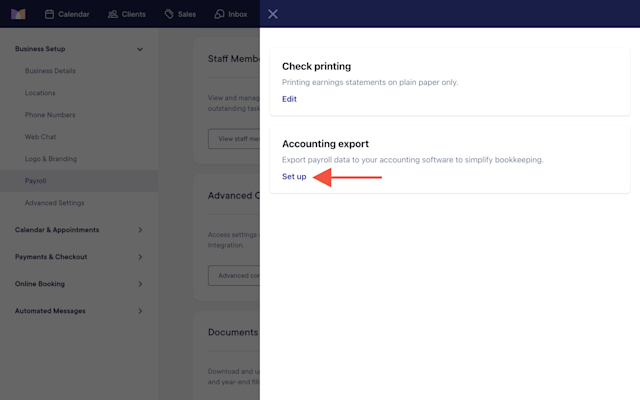

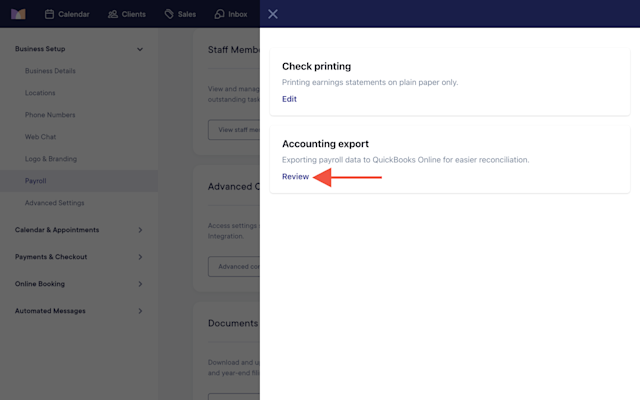

Select Set up under Accounting export.

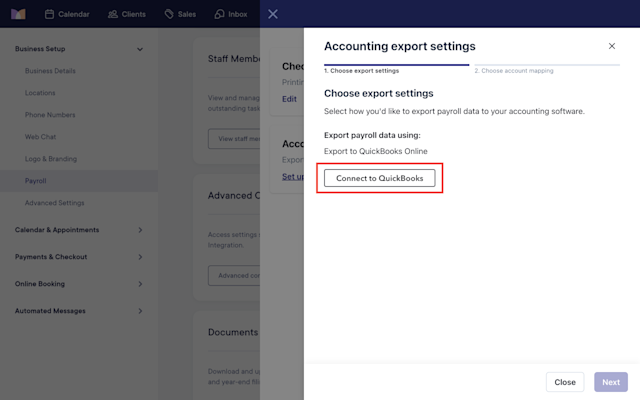

Select Connect to QuickBooks. You will be prompted to log in to your QuickBooks account and authorize the connection.

Once your QuickBooks account is connected, update your export settings and select Next.

Payroll runs: Specify whether you’d like to sync new payroll runs with QuickBooks automatically or manually.

Payroll adjustments: Specify whether you’d like to sync payroll adjustments with QuickBooks automatically or manually. Payroll adjustments include any changes made to a payroll run after it’s submitted, including corrections and voided payroll runs.

Export timing: Specify when you’d like to sync new payroll runs with QuickBooks. We recommend selecting After payments are complete. This ensures that if you need to cancel or edit a payroll run after it’s submitted, you won’t need to log in to QuickBooks and manually update the data.

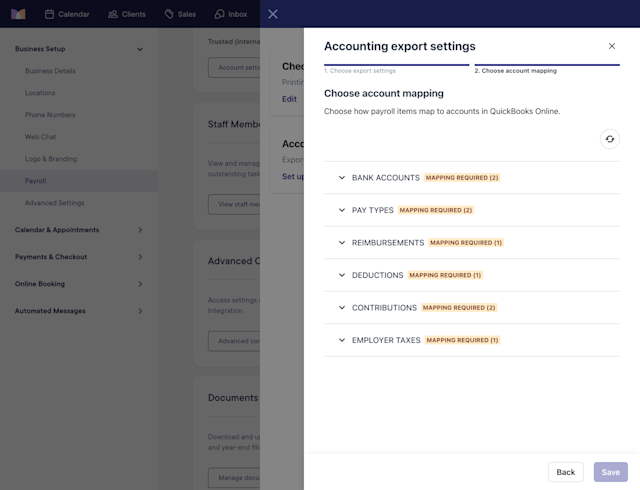

Once you’ve updated your export settings, update your account mapping. This allows you to specify how your payroll data should be mapped to your chart of accounts in QuickBooks. The table below provides general guidance on how to map your payroll data. However, please consult an accountant if you need help determining how to map your payroll data.

Mangomint payroll data | Description | Typically mapped to |

|---|---|---|

Bank Account | Where the payroll funds are withdrawn from. This account reflects actual cash movement—net pay to employees, taxes, and contributions. | Bank Account |

Wages – Salary | Fixed pay for salaried employees, including base pay. | Expense Account |

Wages – Hourly Compensation | Hourly wages for staff who are paid by the hour. | Expense Account |

Wages – Service & Product Compensation | Commissions or service-based pay tied to sales or performance. | Expense Account |

Wages – Overtime | Additional wages paid for hours worked beyond standard schedules. | Expense Account |

Wages – Bonus | Discretionary or scheduled bonuses paid to employees. | Expense Account |

Tips | Employee tips collected by the business and paid out through payroll. These are owed to employees until distributed. | Liability Account |

Employer Taxes | The business’s portion of payroll taxes (FICA, FUTA, state, etc.). | Expense Account |

Employee Deductions (401(k), Health, etc.) | Amounts withheld from an employee’s paycheck for benefits or savings. These funds are owed to third parties (such as a 401(k) provider or insurance company). | Liability Account |

Employer Contributions (401(k), Health, etc.) | The employer’s contribution toward benefits such as retirement or insurance. | Expense Account |

Benefit Liabilities | Combined total owed to benefit providers (both employee deductions and employer contributions) until paid out. | Liability Account |

Once you’ve updated your account mapping, select Save to finish setting up the QuickBooks payroll sync.

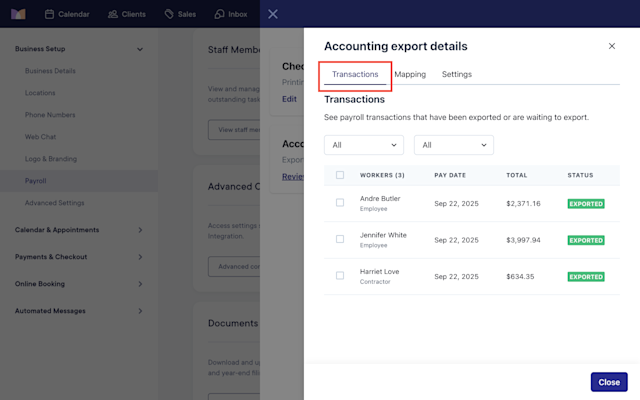

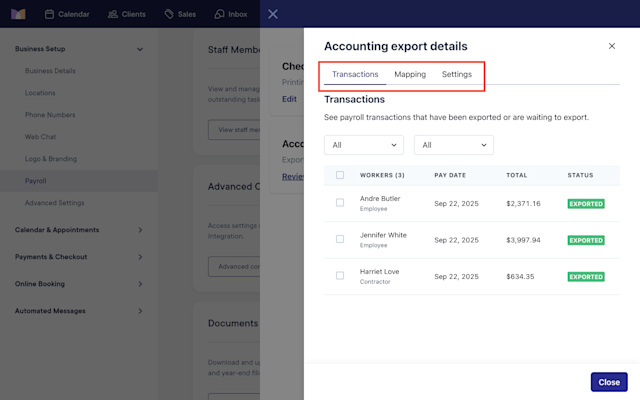

After running payroll in Mangomint, your payroll data will be synced with QuickBooks according to your selected export settings and account mapping. To view payroll data that was synced (or that needs to be manually synced), select Review under Accounting export and select the Transactions tab.

In QuickBooks, you can view synced payroll data in your standard Journal report. Make sure to filter the report to include the pay date you’d like to view.

Link copiedUpdating your payroll sync settingsLink copied

To view or update your account mapping or export settings, open the Settings app and go to Business Setup > Payroll > Advanced configuration. If you have multiple payroll accounts, select Manage account > Advanced configuration.

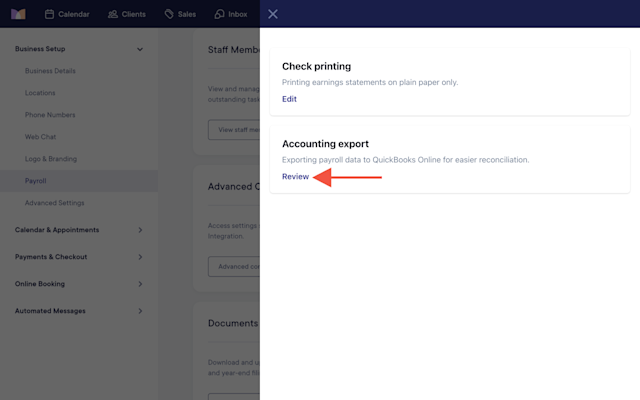

Select Review under Accounting export.

Select the Mapping tab to update your account mapping, or the Settings tab to update your export settings.

Can't find what you're looking for?

with us to talk to a real person and get your questions answered, or browse our on-demand videos.